The startup’s Bank Box enables easy signup, instant activation of the terminal, and lifetime zero rental, and zero effective MDR for merchants. Small businesses can collect and pay digitally even without a bank account.

Mumbai-based point-of-sale terminal solutions provider Mswipe has announced the launch of “Bank Box”, a digital acceptance and payment solution designed to meet the cost-centric needs of MSMEs and merchants, as well as provide a seamlessly integrated experience.

With the increasing demand in digital payment modes Mswipe, through this launch, aims to pave the way for a futuristic payment solution platform and address key challenges that merchants and MSMEs face, with recurring costs on POS terminals like PoS rentals and Merchant Discount Rate (MDR).

Mswipe with a network of 6.75 lakh POS and 1.1 million QR merchants, aims to build a cutting edge product that combines their acquiring and issuing platforms into a one-stop-shop, “Bank Box”, which enables easy signup, instant activation of the terminal and lifetime zero rental and zero effective MDR for merchants.

Manish Patel, Founder, and CEO, Mswipe said, “COVID-19 has significantly impacted the earnings of small businesses, which in turn has led to curbed expenditures from their end. As a market innovator, Mswipe is helping MSMEs and merchants control costs incurred while accepting digital payments and further incentivize them to make digital payments. Essentially, Mswipe’s Bank Box facilitates small, medium, and micro businesses to break into the digital ecosystem at the lowest possible TCO and sign up – even if they do not have a bank account.”

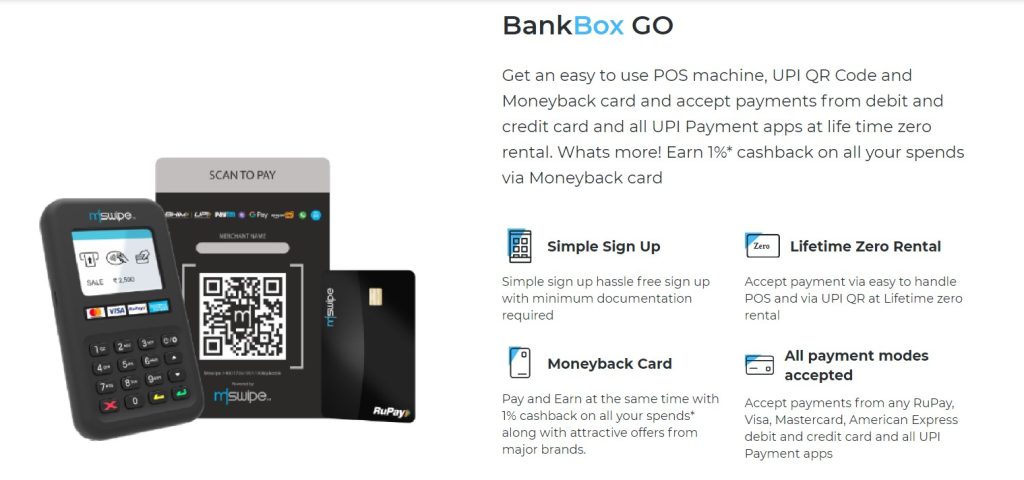

With a one-time digital KYC, businesses can choose between Bank Box Go – a POS solution with zero rental and zero MDR or Bank Box Lite – a QR solution with 0 rental and 1% cashback on all transactions and instantly go live. In both offerings a merchant gets a UPI QR and a Moneyback Card. Bank Box Go additionally provides an affordable mPOS capable of accepting chip + pin and contactless card payments. For Bank Box Go merchants have to pay a one-time fee of Rs. 4,000 plus taxes while for Bank Box Lite, they pay only Rs.199 plus taxes.

“With Bank Box, we have democratized the digital acceptance and payments ecosystem for the smallest of businesses by giving them a choice. With Mswipe now both an acquirer and issuer, we have provided end-to-end digital enablement of MSMEs and merchants and empowered them to join the Digital Bharat movement” Sameer Hoda, President, Strategy, and Operations, Mswipe said.

While mPOS allows acceptance of multiple modes of payments including UPI, Visa, Mastercard, and American Express, mQR accepts payments from more than 150 UPI and mobile banking apps like PayTM, Axis Bank, and BHIM among others. To spend digitally, merchants can load their Mcard with up to Rs. 1,00,000 per month

Mswipe is targeting merchants with an average daily digital collection of Rs. 2,000 – Rs.2,500 in tier 3-4 markets and Rs. 8,000 – Rs. 10,000 in Metro and semi-urban areas.

About Mswipe:

- Mswipe aims to be India’s largest financial services platform for SMEs and merchants by providing seamless mobile POS and value-added Services.

- It is the largest independent mobile POS merchant acquirer and network provider with 6.75 lakh POS and 1 million QR merchants across the country.

- Mswipe offers a host of POS solutions for all types of payment acceptance – cards, wallets, mobile payment apps and bank apps, contactless, and QR payments.

- Headquartered in Mumbai, Mswipe began operations in 2011. Its key investors include B Capital, UC-RNT, Falcon Edge Capital, Matrix Partners India, DSG Partners, and Epiq Capital.