There has been a notable increase in the number of GST registered taxpayers.

The government has made a collection of whooping 10.12 Lakh Crores in the FY 2020-21 amidst the pandemic situation in India.

However, there has also been many fraudulent cases reported for incorrect claiming of Input Tax Credit under GST, fake invoices and many more. The primary thing to look at here is that many professional are indulged in these tax scams ranging from Chartered Accountants to lawyers to even tax advisors.

It has become necessary to verify the person you are getting in business with.

GST number online verification is the most primary task that the taxpayer should do to identify a genuine taxpayer and a fraudulent or dummy supplier.

In this short article, we will be discussing some steps you can take to verify the genuineness of your suppliers.

Verify GST supplier by details on tax-invoice

The preliminary investigation that any responsible taxpayer should consider is to verify the GST details mentioned by the supplier on the tax invoice.

If the tax invoice from your supplier misses any of the following mandatory fields, then it should be an alarming sign for you that the tax invoice is fake:

- Name, address and GSTIN of the supplier;

- Tax Invoice number;

- Date of issue;

- Name, address of the business and GSTIN of the recipient;

- Shipping & billing address;

- Place of supply;

- HSN code or SAC code;

- Items details like-

- Description of goods & services

- Quantity of the goods sold

- Standard unit of measure (Kg, tons, litre)

- The aggregate value of supplied goods or services

- The taxable value of the supply of goods/ services;

- Tax rates & tax amounts properly segregated (CGST, SGST, IGST or CESS);

- Signature of the supplier.

Every recipient should check these details as the first step of the preliminary investigation in the best of his interests.

If discrepancies are found in the details, you should immediately contact the supplier and ask for an explanation. If it’s a genuine mistake, insist he rectifies it as soon as possible.

But, if the supplier tries to hide things and give you vague answers, then it is better to blacklist that supplier from further transactions.

If everything on the invoice looks well & good, you should proceed with some other checks as discussed below.

GST Verification online via GSTN

GSTIN of the supplier should be verified online via the GSTN network.

Following are some of the essential details about GSTIN and the process to verify your supplier’s GSTN.

- GSTIN is the acronym for ‘Goods and Services Tax Identification Number.’

- GSTIN is the 15 digits alphanumeric number issued at the time of GST registration to every taxpayer.

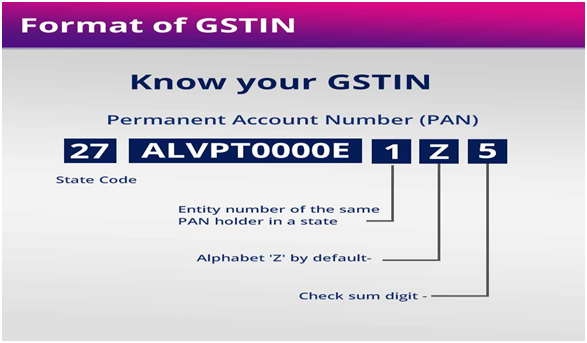

- The format of the GSTIN number is explained below:

To understand the meaning of each value, see the given table below:

| GSTIN Value | Representation & Meaning |

| First two digits (27) | State code of the taxpayer |

| Next ten digits (ALVPT0000E) | PAN number of the registered person |

| 13th digit (1) | Frequency of registration done by this registered entity |

| 14th alphabet (Z) | This is a default alphabet ‘Z’ found in every GSTIN |

| 15th alphabet or number | This is a checksum character and can be a number or an alphabet |

If any discrepancy is found in the GSTIN number should raise the flag that this supplier is not a genuine one, and you should immediately stop all the transactions with that supplier.

Tax experts advise the taxpayers to use the automated GST filing software so that the defaulting suppliers can automatically be notified.

This helps you in claiming 100% Input Tax Credit under GST.

GST verification online via GST portal

There are two ways to verify your supplier on the GST portal:

- Using GSTIN or UIN of the concerned supplier

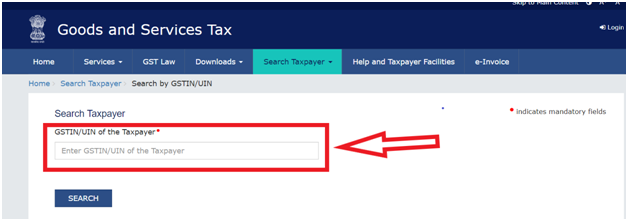

Step 1: Log on to the GST Portal, and navigate to Home >> Search Taxpayer >> Search by GSTIN/UIN.

Provide the GSTIN of the supplier in the highlighted box.

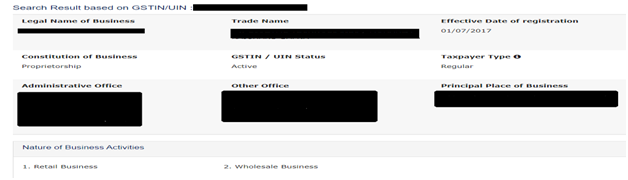

You’ll get the results as follows after hitting ‘Search.’

2. With PAN details of the supplier

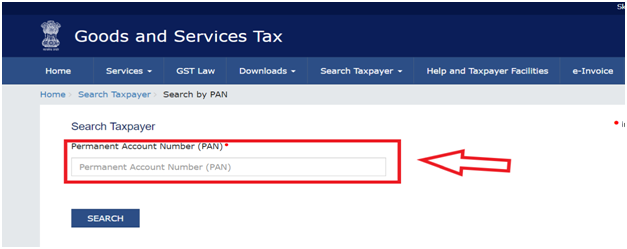

If a supplier is new to the GST structure, it is possible that he may not have received the GSTIN or UIN yet.

In this case, the GST portal allows you to check the credibility of your supplier using his PAN card details on the GST portal.

Step 1: Visit the GST portal i.e. https://www.gst.gov.in/. >> Search Taxpayer >> Search by PAN

With this facility, you can access the supplier details corresponding to the PAN card details provided.

To Summarize

This article has provided you with some primitive measures that you can take to identify genuine suppliers and fake suppliers.

Suppose you are using any GST filing software like GSTHero. In that case, you will have no worries regarding the GST compliances or getting into any fraudulent transactions with a sketchy supplier.

However, at a primitive stage, every taxpayer must follow the steps mentioned in this article so that you can prevent the mishap way before it occurs.

Getting into a fraudulent transaction can have profound tax implications leading to civil proceedings and even cancellation of your GST registration.

So it is always good to be cautious and alert about the compliances and changing rule of the GST.

Stay updated; stay ahead.