Mumbai-based early-stage fund house Unicorn India Ventures (UIV) with a pan India presence, has achieved its first close for Fund III, totaling $27.09 million. The fund, with a target corpus of approx. $120.4 million, is set to reach its final close by March 2024.

With this Fund, UIV aims to build a portfolio of 25 startups that are focused in global SaaS and digital platforms, Unicorn India’s expertise areas. From the sector’s perspective, the Fund is also exploring investments in newer sectors such as climate tech, agritech, spacetech, and the semiconductor ecosystem.

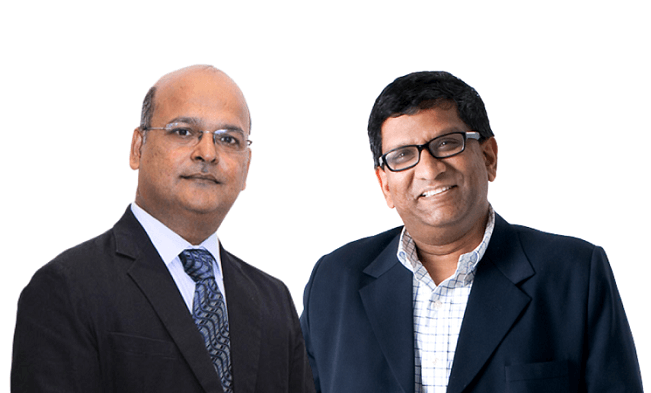

Founded in 2016 by Bhaskar Majumdar and Anil Joshi, Unicorn India Ventures is a technology-focused early-stage venture fund specializing in investments within emerging sectors. Following the success of its inaugural fund, Unicorn India Ventures introduced Fund II, a $36.12 million fund launched in 2020, which has shown remarkable growth. Many of the companies in its portfolio secured multiple rounds of funding within the initial two years post-investment. Fund II currently manages a portfolio of 20 companies. With two funds under its management and an active portfolio comprising over 35 companies, UIV has consistently demonstrated its knack for identifying unique startups. Notably, a significant portion of the startups in their existing portfolios is either profitable or on a clear trajectory towards breaking even.

With the Fund III, Unicorn India Ventures would continue with their strategy of being the “first institutional investor”. The Fund would look at investing a first cheque of around $ 1 -2 million dollars and would then look to invest in the follow on round. As a part of their investment thesis, UIV invests only 20% of its investible corpus to create the portfolio and the rest to back the winners of the portfolio.

Bhaskar Majumdar, Managing Partner, Unicorn India Ventures said, “We continue to identify innovative business models with faster scalability. The metrics for us is a clear path to profitability for the companies. Being the first institutional investors, before doing any investment we spend considerable time with the founders to understand their vision, team’s capabilities, growth plans and leadership style. Our focus is to invest in companies that are enablers of India’s digitisation across sectors. We avoid high cash burn businesses like D2C, Consumer Internet, content businesses.”

We believe the raison-d’etre of our existence is to give cash returns to our investors and in this regard, we are clearly one of the best performing funds. We are focussed on bringing newer pools of capital to the country both for co-investments in our portfolios as well as for secondary divestments. Over the years, we have built strong relationships with international funds and family offices that don’t have a physical presence in India but are keenly looking at the India growth story, he adds.

Anil Joshi, Managing Partner, Unicorn India Ventures says, “We have always believed in the Bharat story as much as the India story. While we have invested in startups from Delhi, Mumbai and Bangalore but over 60% of our portfolio is built from startups coming from emerging regional hubs like Kochi, Jaipur, Ahmedabad, Pune and Hyderabad amongst others. Unicorn is perhaps the only fund which has worked tirelessly with state govt in Kerala, Orissa, Madhya Pradesh to roll out startup policy with an aim to find high potential startups from tier 2 and 3 cities. Our key differentiator is that we are present across India and believe that India’s startup landscape has changed immensely over the past couple of years. With this third fund, our commitment to nurture Indian startups will be unwavering and we will keep scouting for highly innovative companies whose disruptive solutions can address real life problems of users by leveraging technology.”

Unicorn India Ventures has also announced senior hiring for Fund III.

The fast-growing team is joined by Bikram Mahajan as a Partner. Bikram will play a key role in the next phase of the Fund’s growth, with a primary emphasis on portfolio management and nurturing the growth of investee companies. Bikram comes with 20 years of experience in private equity and investment banking with the last decade in fund management. He is an alumnus of IIM Calcutta. Discussing his new responsibilities, Bikram Mahajan, Partner, Unicorn India Ventures, says, “Leveraging my track record and experience, I aim to contribute my knowledge, network and expertise to help the fund scale its business.”

Kamlesh Ahuja joins as VP (Fund Operations) responsible for all compliance and back-office administration for all the Funds. He has 15 years’ experience in fund operations with large cross sector funds as well as with trustees.