The last quarter saw funding across 20 sectors out of which Healthcare, Fintech and Enterprise Software emerged as the hottest ones

“How much do I need to dilute while raising an angel round?”

“Will investors agree to this?”

“Is it too low or am I diluting more than required?”

We get a lot of questions along these lines and thought it’s time to share insights around fundraising and valuations.

To make it easy to digest; in this post, we split the data into two categories. First, we look at the funding ask and valuation numbers of the 3 hot sectors (based on the number of deals done). Then we follow up with a macro view of what is happening in the angel fundraising ecosystem. Angel fundraising ecosystem = ask in the range of INR 1 crore to 9 crore.

The Data in consideration here includes a sample size of 650+:

- Startups who applied for fundraising on LetsVenture in Q2, FY 16-17

- Funded ventures in Q2, FY 16-17 on LetsVenture and publicly available information

If you are not a Fintech, Healthcare or Enterprise Software, you may want to jump to the second part of the post from here.

A. Valuation and Ask range for 3 hot sectors

The last quarter saw funding across 20 sectors out of which Healthcare, Fintech and Enterprise Software emerged as the hottest ones.

So We went a step further and looked at the range of valuation and funding ask of the companies who demanded investment (Demand) and who were funded (supply).

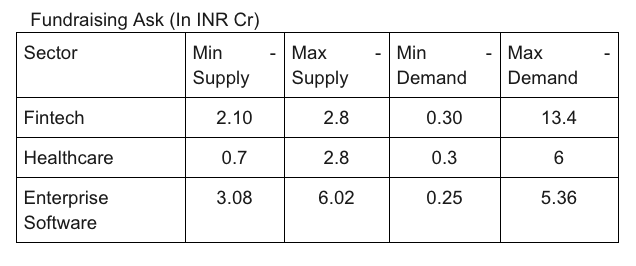

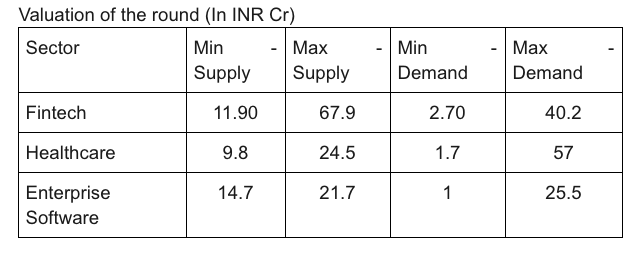

I. Fintech

Fintech was on fire with respect to ‘the startups looking to raise funds’ and ‘startups who successfully raised funds’. The companies types were spread across Mobile payments, Trading, SME/Enterprise Payments, Personal Finance and Lending.

Founders looked to raise between INR 0.3 Cr to 13.4 Cr and valued themselves from INR 2.7 Cr to INR 40.2 Cr. We saw around 4-5 Fintech ventures raising funds in the second quarter of the current financial year. The funded companies have raised funds in the range of INR 2.1-2.8 Cr and were valued between INR 11.9 Cr to as high as INR 67.9 Cr.

Fintech founders that looked to raise funds dilute their startups about 10-25% while the successfully funded ones diluted 4-15% of their respective companies. If you’re a fintech founder reading this, you might want to review your fundraise numbers once 🙂

II. Healthcare

We saw a large growth in the number of fundraising startups and successfully funded startups in the market. Healthcare saw 3-4 ventures getting funded in July to September of that year. The ventures willing to raise funds were majorly spread across Healthtech, Healthcare Services, Health & Wellness, Manufacturing, Home care and Healthcare IoT.

Founders were looking to raise between INR 0.3 to 6 Cr and valued themselves at INR 1.7 to 57 Cr. The market funded companies in the range of INR 0.7 to 2.8 Cr while the investors in healthcare were comfy with valuations ranging from INR 9.8 to 24.5 Cr. Quite similar to fintech, #trend anyone?

Healthcare founders were willing to dilute 9.5-15% of their company while the market is offered 6.67% to 10.25%. Healthcare founders, looking to redo your valuations?

III. Enterprise Software

Looking at the inbound number of fundraising startups, investor interest and ventures getting funded, it can be concluded that Enterprise Software is definitely an #Emerging sector. Success of companies such as Freshdesk, ZOHO etc. has really given a boost to the entire sector. For those who are not aware about this sector, Enterprise Software companies make products (in form of SaaS, PaaS, IaaS, DaaS etc.) for companies, both SMEs and Enterprises. For most part, we see companies in Cloud, Security, Customer Support/Engagement, Retail Tech, Health/Education Tech, Big Data, BPOs and Accounting.

Enterprise Software founders looked to raise between INR 0.25 to 5.36 Cr and valued themselves at INR 1 to 25.5 Cr. On the flipside, startups raised between INR 3.08 to 6.02 Cr and were valued between INR 14.7 to 21.7 Cr. This meant founders were willing dilute between 17.3-20% and successful fundraises happened between 18.1-21.7%. Fairly balanced!

Moving on, let’s look at the fundraising ask and valuation numbers for ALL the funded sectors:

B. Valuation and Ask of Fundraising and Funded Startups

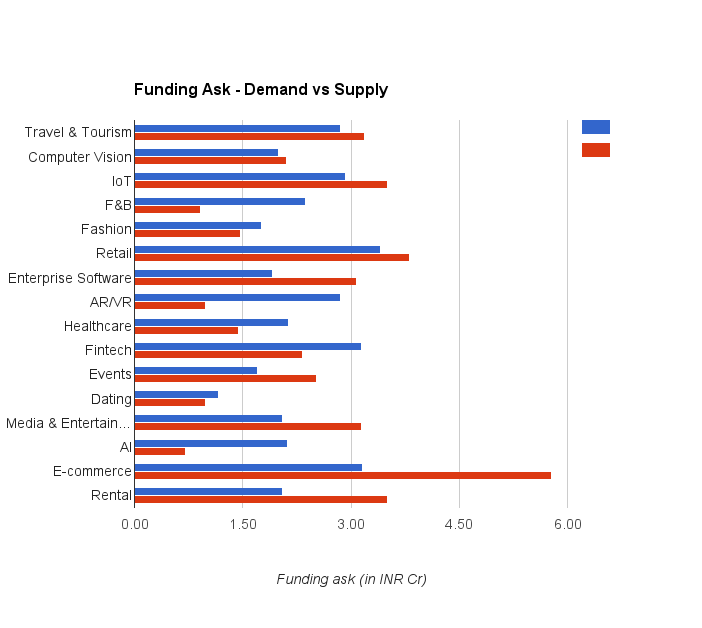

1. Demand vs supply of fundraising ask

We looked at funded sectors in the angel funding ecosystem and plotted the funding ask of fundraising startups and the actual amount raised by the #funded startups.

Funding Legend : (red – supply (i.e., funding available), blue – demand (i.e., funding asked)

Key Takeaways:

Key Takeaways:

- The market supplied more money than demanded to Travel & Tourism, Internet of Things, Retail, Enterprise Software, Events, Media & Entertainment, E-commerce and Rental.

- The market doesn’t agree with funding demand for Food & Beverages #duh, Augmented Reality/Virtual Reality, Healthcare, Fintech and Artificial Intelligence;

- Computer Vision, Fashion and Dating are well balanced on the demand and supply.

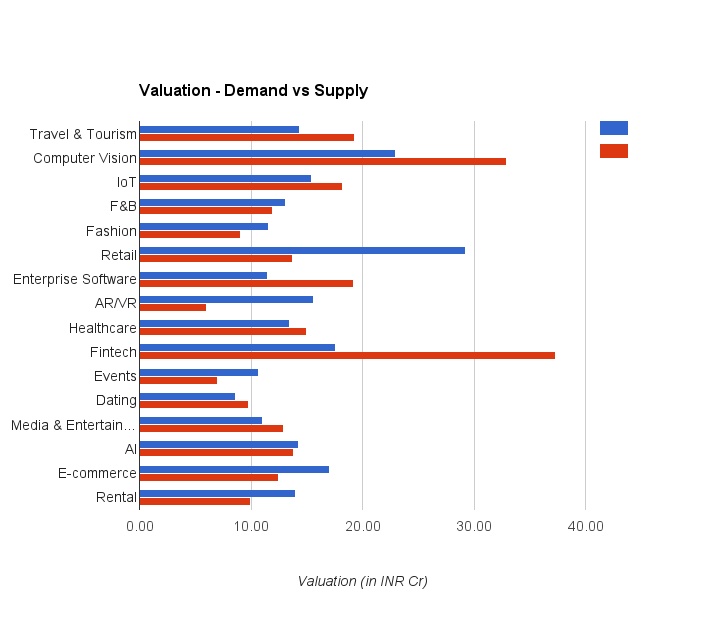

2. Demand vs supply of Valuation: sector wise

Next, we looked at the valuation numbers for all the funded sectors and plotted that in the graph below.

Valuation Legend (red – supply (i.e., valuation finalized), blue – demand (i.e., valuation asked)

Key Takeaways:

Key Takeaways:

- The market is valued higher than the ask for Travel & Tourism #surprising, Computer Vision, Internet of Things, Enterprise Software, Healthcare, Fintech, Media & Entertainment.

- The market doesn’t agree with demand for Fashion, Augmented Reality/Virtual Reality, Events, E-commerce and Rental;

- Food & Beverages, Retail, Artificial Intelligence and Dating match well on the demand and supply.

Wrapping things up, a few observations for the sectors we’ve discussed:

- Travel and Tourism, Internet of Things and Enterprise Software are market #hotties

- The future of Computer Vision is looking up

- The market sentiment has turned negative for Food & Beverages but we can still see funding in Food RnD and Packaged FnB.

- Retail and Healthcare are still hot in the market but that means expect tougher competition

- Augmented Reality/Virtual Reality is an emerging sector

- Fintech is probably the hottest sector in the market at present

- E-commerce and Rental are still seeing a lot of funding but after compromises on the valuation.

If you’re interested we’ve attached an appendix for part 1 below:

Hope you find this useful. If you missed our Introduction post on the 5 Big Questions we’ll be sharing data insights on, you can click here to check it out.

Hope you find this useful. If you missed our Introduction post on the 5 Big Questions we’ll be sharing data insights on, you can click here to check it out.

Lastly, applications for LetsIgnite are closing on Jan 15th 2017 so hurry and apply if you’re looking to get funded or find a lead investor.

Stay tuned and let us know if you have any questions, reach us at [email protected]

Happy Fundraising, you got this!

—

The post Funding Ask & Valuation 101 For Founders originally appeared on LetsVenture blog.

LetsVenture’s flagship event LetsIgnite conference is back. This March, 300+ Angels, 25+ VCs and 20+ Lead Investors will meet and network at the event. It’s opening up the event to both early and growth-stage startups looking to raise funds, partner with VCs and more. Click here to get started, applications close on Jan 15th!

Image Credit: Pixabay