Sigmoid, a data engineering, analytics and AI solutions company, has closed a Series B investment of $12 million, in a mix of primary and secondary funding from Sequoia Capital India.

This takes Sequoia India’s total investment in Sigmoid to $19.3 million.

The new capital will fuel Sigmoid’s plan to evolve its market offerings, expand delivery centres and cater to new industries.

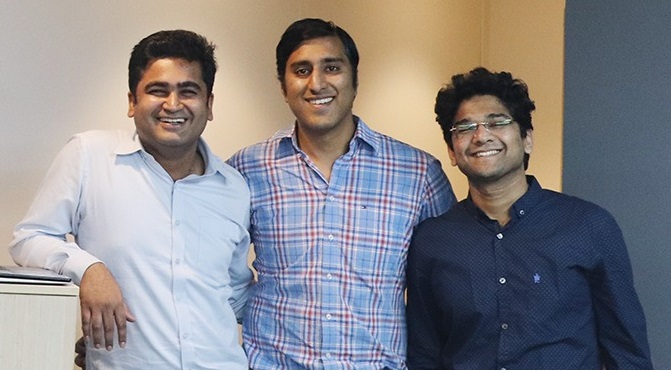

Founded in 2013 by IIT alumni Lokesh Anand (CEO), Mayur Rustagi (CTO) and Rahul Kumar Singh (CAO), Sigmoid helps accelerate digital transformation for enterprises across industries with data. Sigmoid builds reliable, scalable data pipelines and accelerators which empower organisations with faster access to business insights.

By 2025, Gartner states that 80 per cent of organisations seeking to scale digital business will fail because they do not take a modern approach to data and analytics governance. Enterprises today struggle to reap the full benefits of the data ecosystem, and Sigmoid aims to address this with its cutting-edge data solutions, AI engineering, and cloud data migration services.

Leveraging an agile framework for data, Sigmoid focuses on delivering high ROI to customers in the shortest possible time.

Additionally, the prebuilt accelerators deliver a high success rate for analytics initiatives while ensuring fast delivery of projects consistently.

“The last 12 months have been an inflexion point in our growth story. This funding will help us to rapidly expand our capabilities in terms of solutions and talent to meet the ever-growing customer demand,” said Lokesh Anand, CEO and Co-Founder at Sigmoid.

Sigmoid has been helping organisations accelerate their digital transformation journey while adding scalability and agility:

For a leading F500 FMCG company, Sigmoid developed self-adapting multi-touch attribution models to optimise the in-flight campaigns, generating faster bi-weekly insights in a cost effective manner. This resulted in an 11 per cent improvement in the return on marketing investments.

In another case, for a leading investment bank, Sigmoid developed, implemented and optimised the trade surveillance infrastructure to detect MAR, MiFID II and other regulatory compliance issues faster and more accurately. With the new infrastructure they could efficiently process over 100 million rows of daily data and resolve various data integrity and latency challenges in their data pipelines.